| Home | The Book | Training | Events | Tools | Stats |

June 15, 2006

Pump-And-Dump TechniquesPenny stock scams litter many an inbox. The recipient supposedly gets some inside information about a low-priced stock that is going to "explode" in a day or two because of news that will be announced on that day. The scammers, of course, wait for the suckers to bid up the price in anticipation, and then they quickly sell for a tidy profit ahead of those who caused demand for the stock. Thus the name: pump-and-dump. I have seen at least one study that traced performance of spammed penny stocks, and the typical pattern is an immediate increase in trading volume, during which the price may "surge" a few cents; after that, the stock goes into a steady decline.

Finding the sources of these messages is difficult. The return addresses are uniformly bogus, they're relayed through botnets, and there are no links to follow because the action to be taken by recipients is through their brokers or self-trading accounts. Yet the fact that the messages generally are not openly sponsored by any reputable person or organization doesn't stop the gullible from losing money in the process. Also, because the SEC did hunt down some of these guys once, the P&D spammers include disclaimers that will get them off the hook if they should be caught. Oddly (or perhaps not), there are apparently enough gamblers in the market to ignore the disclaimer warnings to keep the scam working.

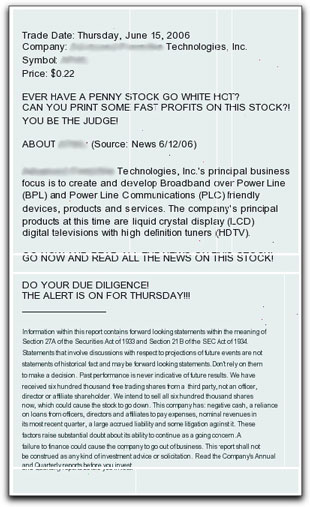

P&D messages that have text in them are usually easy to filter because they include readily identifiable phrases and abbreviations. That has led the P&D scammers to embed their complete spiel in an image that accompanies the message. My seldom-used Comcast inbox seems to be a magnet for these types.

I wonder if some ISPs are now using character recognition on embedded images to filter out this junk because I just saw something today that shows the scammer jumping through extra hoops to avoid such a possibility. The typical P&D image has been divided into many pieces, and the HTML in the message assembles the attached pieces into a (mostly) readable end product. Here's what it looked like in my email reader (I've blurred the identifying stuff):

The little extra white spaces makes it look a bit like a ransom note, which would give me pause (but then I don't invest in individual stocks). I looked into the recent record of the stock being pumped in this message. It had hit a one-year low point yesterday, so that's a good time to pump it up. Unsurprisingly, trading volume today was more than 2.5 times above average. If you had owned this stock at yesterday's closing price ($0.22), you could have sold it for as much as $0.29 today, for a better than 30% return. But if you had tried to buy any today (there appears to have been some after-hours activity that drove the opening price to $0.26), you'd have lost by the end of today's trading.

If you'll excuse my high-finance terminology, I simply find a stock touted by an unnamed spammer to be too icky.

Posted on June 15, 2006 at 02:03 PM